In the crypto finance realm, there has been much debate regarding Bitcoin’s potential as a safe haven asset. Most discussions revolve around its correlation with other assets during market turmoil. However, several key attributes that investors prioritize during crises are often overlooked. Compared to traditional safe havens like gold, Bitcoin is more volatile, less liquid, and costlier to transact with, even under normal market conditions. Until the market matures, it is doubtful that Bitcoin can be considered a reliable safe haven.

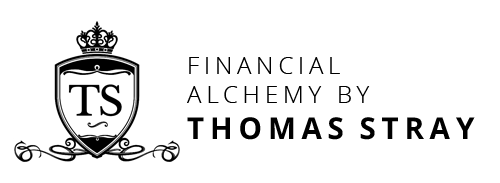

Bitcoin vs. Nasdaq and Nikkei Bubbles

To better understand the situation, we’ll examine the similarities and differences between Bitcoin and the Nasdaq and Nikkei stock indices during their respective bubble periods. To do this, we’ll compare their price levels by normalizing them to 100 at the beginning of the analysis, which is 1652 trading days before each of their respective peaks. The Nikkei 225 index reached its highest level at 38,916 on December 29, 1989, while the Nasdaq index peaked at 4,705 on March 27, 2000. Bitcoin, on the other hand, saw its highest value at $18,941 on December 18, 2017.

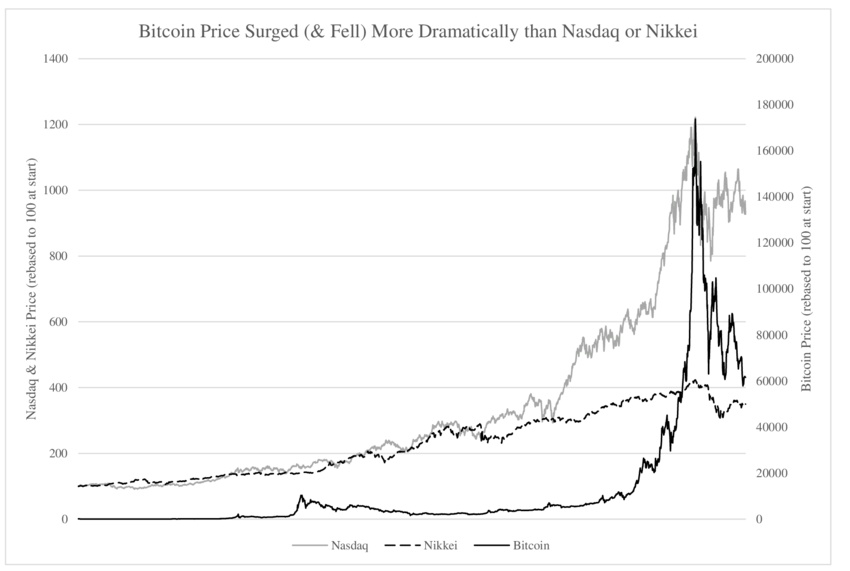

Standard Deviation of Returns (Rolling Window)

Moving on, let’s look at the standard deviation of returns as a way to gauge the volatility of different assets. The following data demonstrates the standard deviation of returns for Bitcoin (BTC), gold (GLD), and S&P 500 (SPY) ETFs, as well as the yields on 10-year treasury notes (TY) within a six-month rolling window.

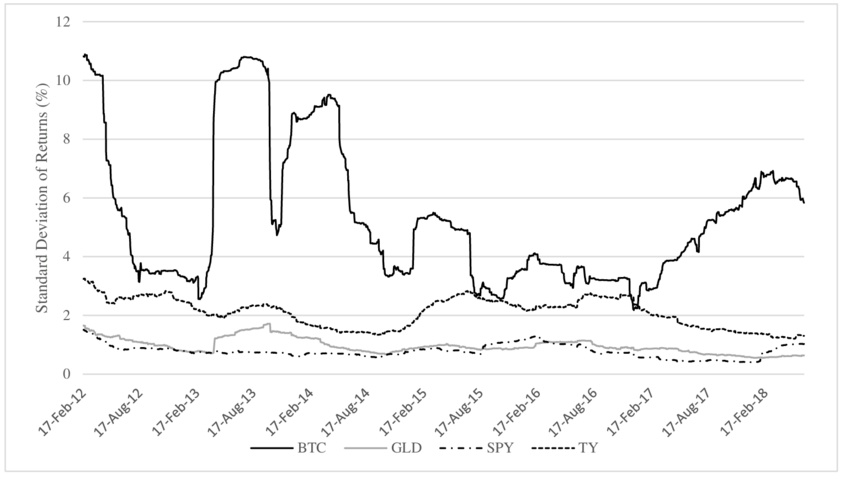

Bid-Ask Spreads

Lastly, we’ll discuss the impact of bid-ask spreads on asset liquidity. The subsequent data displays bid-ask spreads, represented as a percentage of the current asset price, for Bitcoin (BTC), gold (GLD), and S&P 500 (SPY) ETFs, in addition to Apple (AAPL) and Twitter (TWTR) stocks

Conclusion

While research continues into Bitcoin’s potential as a safe haven asset, it is essential to consider its other attributes impacting investors during times of crisis. Currently, Bitcoin’s higher volatility, lower liquidity, and transaction costs make it less appealing than traditional safe haven assets like gold. Until the market matures and these issues are resolved, Bitcoin is unlikely to be a viable safe haven option for investors.

At Endemaj Funds LLC, we maintain an optimistic outlook on Bitcoin’s future, particularly as a long-term investment. Despite its current limitations as a safe haven asset, the potential for growth and value appreciation cannot be disregarded. One notable event on the horizon bolstering our optimism is the upcoming Bitcoin halving.

The halving, which occurs approximately every four years, reduces the rate at which new Bitcoins are created by half. This event effectively limits the overall supply of cryptocurrency, thereby increasing its scarcity. Historically, halving events have had a significant impact on Bitcoin’s price. In most cases, a bull run has either preceded or followed the halving, leading to substantial price increases.

As we approach the next Bitcoin halving, it is reasonable to expect a similar pattern to emerge. Investors who hold onto their Bitcoin for the long term may potentially benefit from this anticipated bull run. However, it is important to remember that past performance does not guarantee future results, and the price of Bitcoin remains inherently volatile.

In conclusion, while Bitcoin may not currently serve as a viable safe haven asset, its potential for growth and value appreciation in the long run cannot be overlooked. With the upcoming halving event, Endemaj Funds believes that there is a strong possibility for a bull run, making Bitcoin an attractive long-term investment option for those who are willing to accept the associated risks.

It is essential for investors to stay informed about market developments and conduct thorough research before making any investment decisions. As the cryptocurrency market evolves and matures, the status of Bitcoin as a safe haven asset may change. For now, investors should carefully consider their risk tolerance and investment objectives when deciding whether to include Bitcoin in their portfolios as a potential long-term growth asset.